You can easily rating a personal bank loan no earnings confirmation. Although not, it could be challenging to be eligible for you to definitely since the majority lenders want a steady earnings so you’re able to safe a personal bank loan. Additionally, may possibly not become a good idea to put your financial health at risk if you fail to be able to repay the borrowed funds.

The good news is to own gig cost savings gurus having fluctuating money, particular lenders allows you to make an application for a loan and no money or allow you to explore non-work income. Before you submit an application for you to, you will need to seek information and you will consider the benefits and you may drawbacks of going a loan versus a steady money.

Exactly what can You expect Once you Submit an application for Financing Instead of Earnings Consider

The process together with criteria will vary whenever trying to get an effective consumer loan for notice-working with no evidence of earnings. Unlike guaranteeing your revenue, the latest loan providers get look at the personal credit history.

For the loan providers, a good credit score implies that you have a reputation spending bills promptly, leading you to less of a threat for default or non-payment of costs. Although this by yourself will not be certain that loan approval, a superb credit history factors your on the proper direction.

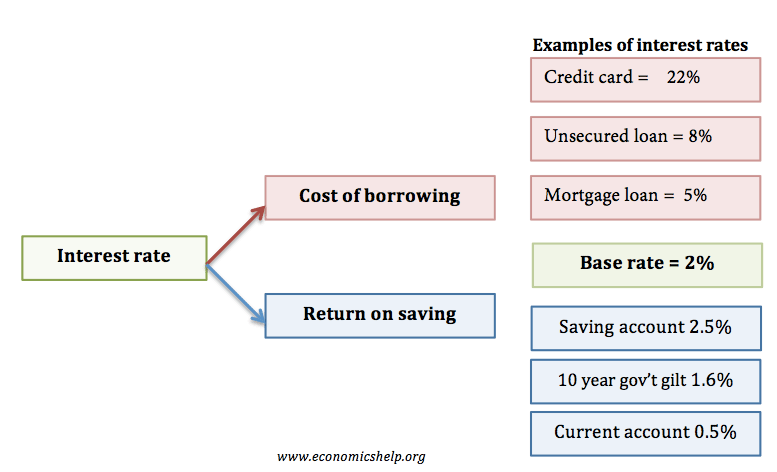

For example, loan providers generally speaking charges lower interest levels for those who have good good credit listing. This permits one to save money on your debt payment expenses, which should be your ultimate goal when making an application for no income confirmation signature loans.

Other than considering your credit score, lenders you will request you to promise or at least present evidence off a secured asset that can be used as equity, like your auto otherwise property. You should illustrate that you or the financial can liquidate this house into dollars to settle their loans in case of a great default. The fresh disadvantage away from pledging guarantee when obtaining personal loans no income verification ‘s the threat of losing you to advantage if you don’t repay the borrowed funds.

In some cases, loan providers will want to protect by themselves by the asking so you’re able to hire good guarantor otherwise co-signer on the mortgage. It guarantor would be to preferably be somebody who can establish a stable income. Just like guarantee, requiring an applicant in order to designate a beneficial co-signer handles the loan organization from financial losings. For those who default, they’ll realize their co-signer alternatively.

Some loan providers are also prepared to let individuals with zero income and an excellent credit rating borrow money. not, the newest numbers readily available is actually somewhat less than the individuals accessible to anybody which have steady income and you will good credit results. Lenders may fees incredibly highest rates of interest loans in Willimantic to help you offset the exposure.

Ultimately, lenders you can expect to need proof of option money apart from your main gig. They might be Social Protection pros when you are retired, dividends out of your assets, and you can public advice financing, as well as others.

Getting ready to Get Loans No Earnings Confirmation

To own care about-working somebody, it is just a matter of go out till the must find investment comes up. Because you work at your company, you can even in the future come across gaps making it burdensome for you to repay utility payments, products restoration, and you may employee payroll for those who get work.

You need to be capable of getting your financial statements managed even before you need certainly to borrow funds. Your very own monetary comments gives possible lenders that have proof typical otherwise, at least, repeated money. Gather records of your own revenue statements and money move that go back no less than 3 months. This is exactly in addition to a way to evaluate if your company is actually in good shape or not.

You might demand a copy of your credit score and get of all around three credit agencies getting a charge. Use the guidance be effective with the improving your credit score. You can start by repaying at least one or a couple of your loans punctually as much as possible. You may seek out errors throughout the account, so you’re able to fix them and increase your credit score.

When it is time and energy to sign up for a consumer loan with no income verification, you’ll have worked during the and work out your credit rating as high as you’ll.

Before applying, you’ll also need to choose a secured item that you could promise just like the collateral whenever expected. A basic option is our house home loan or even the home in itself. But not, you and your partner must’ve produced extreme costs on the residence’s collateral before you can borrow on the mortgage. Most other viable options include the identity on your own auto, assuming that it’s been totally paid down or perhaps is perhaps not utilized once the collateral in another financing.

Option Resources of Loans Getting Money with no Income Verification

- $five hundred to help you $5000 loans

On line financing systems promote personal loans so you’re able to concert economy professionals just who earn 1099 earnings. You should buy quick access to financing for approximately $5000, which you can use to grow your organization. Bank requirements are very different, you must be worry about-working and have a-work reputation of at the very least 3 months having month-to-month earnings in excess of $3000.

- Family and friends

One-way you can purchase financing as opposed to money verification is via inquiring your friends and relations for just one. One which just use the cash, definitely set brand new terms and conditions of your own mortgage. If you are these purchases might or might not include a contract, you might want to err to the side regarding warning and you may set up a proper contract to guard the fresh new passion out-of one another events. The fresh deal would be to story the latest installment procedure, schedule, and you can interest.

So it option brand of funding takes into account your revenue background and you can charges you just a certain percentage of the revenue given that installment. This is exactly like a seller pay day loan but is maybe not limited to charge card transactions just. Lenders have a tendency to familiarize yourself with your financial statements, ount it does let you acquire, and you will vehicles-debit your repayments from your own family savings per month if you do not fully pay the mortgage.

Final thoughts

You should buy a consumer loan and no income confirmation, you may have to take on large interest levels, the new pledging off equity, and you can a strict procedure.

In addition, self-operating some body must consider option kinds of capital that not one of them a reasonable or good credit get. These include family relations funds, Automatic teller machine payday loans, crowdfunding, and many more. These types of non-conventional financial support is really as convenient in the a financial crisis because the loans and other old-fashioned types of investment.